Local governments already have a lot of taxing authority. They can levy sales taxes, parcel taxes, utility taxes, create assessment districts and charge business license fees, among others. There are also, of course, property taxes.

It takes a two-thirds majority of local voters to originate or raise almost any of these levies. In short, Californians get no new local taxes unless a preponderance of local residents wants them. In many cases, local increases pass easily. Just this spring, eight out of 13 school parcel tax proposals passed.

Now comes Darrell Steinberg of Sacramento, the Democratic president pro-tem of the state Senate, who sees local taxing authority as one way out of the state’s persistent financial conundrum, where plenty of basic services have already been cut and most state Capitol analysts believe it will take a renewal of temporary taxes enacted in 2009 to prevent even more crumbling of California’s university systems, parks, roads and safety nets.

With at least two Republican votes in both houses of the Legislature needed even to put an extension on the ballot, and none forthcoming so far, the extensions will likely die at the end of this month barring something extraordinary. It’s questionable whether Gov. Jerry Brown and the Democratic legislative majority by themselves can legally extend those temporary taxes, even for a short time.

Democrats interested in pressuring Republicans to cave in and at least okay a public vote on the tax extensions floated the idea of balancing a budget by targeting cuts only to Republican-held legislative districts. But that kind of vindictive action would penalize not only the GOP voters who put adamant anti-taxers into office, but also their many Democratic neighbors, not to mention children and disabled seniors who live there. Every Republican district contains plenty of Democrats and others.

So that idea had little merit. Then Steinberg came up with an alternative: Transfer even more state functions to local governments than Brown has already proposed – and he has proposed transferring plenty, including the care and feeding of thousands of state prison inmates. Then let local governments pay for this with things like local levies on income, alcohol and oil drilling or vehicle license fee surcharges.

In every case, cities, counties and school districts would still need two-thirds approval from local voters to proceed.

So schools that don’t want to fire more teachers because the tax extensions apparently aren’t happening could ask voters for more money. Counties wanting to take over operations at some state parks whose closure is now planned could do the same. Counties could ask voters for earmarked money to maintain teams of sheriff’s deputies and prosecutors focusing on child abuse, spousal support scofflaws or gang suppression.

No doubt this would leave some areas more equal than others, as George Orwell put it in “Animal Farm.” But haven’t things always been much that way? Services in cities like Beverly Hills and Palo Alto and Rancho Santa Fe have never been the same as in places like Compton or Blythe or Richmond.

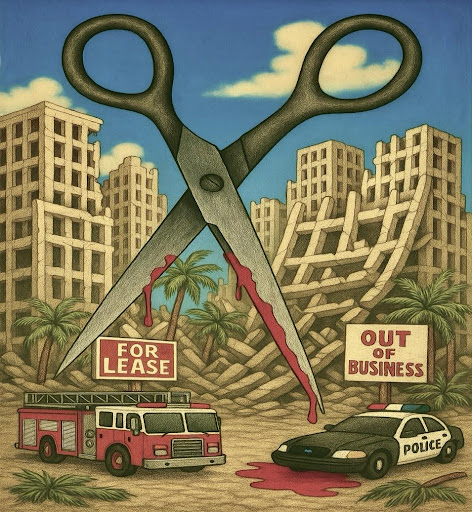

For sure, Steinberg’s proposal would let local voters decide whether to retain — and pay for — past levels of government services, from police and fire protection to quality schools and even frequency of trash collection. Not to mention the option of deciding whether to fund county jails sufficiently so they can avoid freeing convicts about to be shifted from state prisons.

So some parts of California could end up safer than others, depending on the willingness of voters to open their wallets. Some areas, of course, are already safer than others, true. Some would have higher taxes than others. California would become a fiscal mishmash, with each area deciding what it wants to fund.

No one knows how many local governments might try for new taxes and how many would stick to no-new-taxes. But the entire idea horrifies anti-tax activists. “The mind reels at what a clever agency might come up with,” moaned Joel Fox, former chief of the steadfastly anti-tax Howard Jarvis Taxpayers Association.

A real problem with Steinberg’s law might lie, however, in the 40-year-old state Supreme Court decision known as Serrano v. Priest, which found it unconstitutional for some school districts to spend more money than others on each of their students. The same reasoning could apply to cities, counties and fire protection districts. Serrano sees money from wealthier school districts distributed to poorer ones whenever a district adopts an overall tax increase. The decision does not apply to parcel taxes, whose proceeds stay home, one reason many school districts now try for that unfair form of taxation.

So Steinberg’s idea looks good to many who believe local voters should decide their own lifestyles. But it’s by no means certain his plan could survive a constitutional test.