In a step back for affordable housing in Santa Monica, the shorthanded City Council last week unanimously approved the repurposing of the High Place East housing development to become an affordable rental residence. As a result, High Place East will not offer its residents the option of affordable homeownership.

Also approved by the council in conjunction with this agenda item at its Feb. 14 meeting was the issuance of state multifamily housing revenue bonds that will “assist in the financing of affordable rental apartments at High Place East.”

The tax-exempt bonds, which require local approval, would not be issued by the city “nor will the city have responsibility to repay those bonds,” said Director of Housing and Economic Development Andy Agle. Instead, the bonds would be issued by the California Statewide Communities Development Authority (CSCDA).

“The affordable housing at High Place East was originally conceived as an ownership development that would be affordable to moderate income families,” Agle said. “CCSM (Community Corporation of Santa Monica) has been working on the development for nearly 10 years, including securing all entitlements. However, the last hurdle, securing construction financing, has proven elusive.”

Given the current economic climate, Agle said it would be “impossible” for a developer to secure financing for an affordable homeownership project.

“There are several elements to sustaining an affordable homeownership model that creates challenges for lenders,” he said. “In the past few years, the challenges have been compounded by much more stringent mortgage lending criteria, which have made construction financing for all condominium developments very difficult and lending for limited income ownership development very impossible.”

Agle also said that staff recommended the current action “given the continued need for affordable housing in Santa Monica.”

The switch from affordable homeownership project to affordable rental development was upsetting to at least one resident.

“I’m very saddened that this is becoming rental. I think it would’ve been a wonderful experiment in ownership,” Luisa Fish said during the public comment portion of the public hearing.

Council member Bobby Shriver agreed with Fish and expressed his disappointment with the banks.

“(The fact) that banks are unwilling to lend for this kind of housing is outrageous. They seem to have lent for every other form of housing and everyone seems to be continuing to receive bonuses who works at banks,” Shriver said. “The fact that this has not been able to be worked out is disappointing. It would have been nice had the banks stepped up and enabled people to develop equity.”

Still, Council member Kevin McKeown was optimistic that establishing High Place East as an affordable rental development, while not ideal, was a viable alternative.

“We’ve an opportunity … (to) get built very much-needed multi-bedroom affordable rental housing,” McKeown said.

According to the staff report, High Place East was to offer its moderate income residents “equity accumulation resulting from paying a mortgage and some limited price appreciation, potential income tax relief from mortgage and property tax deductions, and housing stability.”

However, among the chief concerns include the affordability of “maintenance, repairs, insurance and homeowner association (HOA) dues” as well as “resale price restrictions that, while creating long-term affordability, results in limited equity gains for the homeowner upon resale.”

There were specific points of the project’s affordable homeownership model that, as the staff report states, “are unattractive to lenders and perceived as increasing risk.”

Among those points included deed-restricted units, limited-equity ownership, a community land trust (CLT) structure, and complicated qualification processes for potential homebuyers.

With deed-restricted units, sale prices are restricted for 55 years and potential buyers must strike a balance between having just enough income to afford the mortgage but not exceed “certain income levels.” Accordingly, as pointed out by city staff, “the pool of credit-qualified and income-eligible buyers is small.”

Further, an affordable homeownership model results in “limited-equity appreciation,” meaning future homebuyers would not be attracted to purchase a unit at a later date because of smaller return on investment.

Loan approvals also face additional hurdles due to the CLT structure, which aim to maintain the project’s affordability but limit’s a homeowner’s exposure to foreclosure.

Finally, potential homeowners are required to endure a “multilayered qualification process” that, according to staff, “increases the drop-out rate of potential buyers who will complete the sale.”

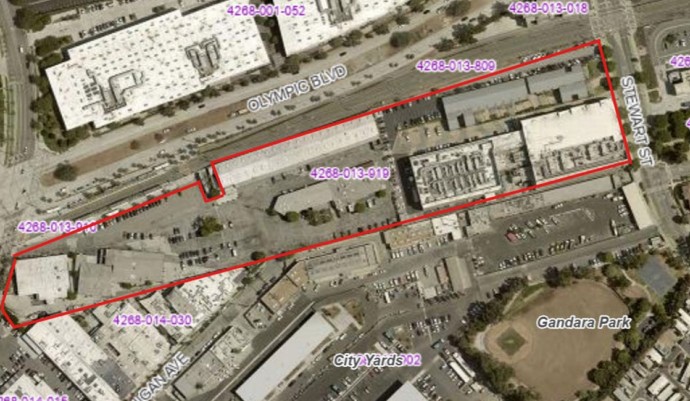

High Place East, which is located near the intersection of Cloverfield Boulevard and Interstate 10 at 1959 High Place and 2349 Virginia Avenue, carries a development price tag of about $23.9 million.

The tax-exempt bonds are worth up to $18 million, according to a resolution that was approved by council members as part of this agenda item.

The Housing Commission considered this issue on Jan. 19 and recommended to council that High Place East indeed be repurposed as affordable rental housing.

Council members were presented in the staff report with an alternative of acting as construction lender and loaning the project about $10 million in order to maintain “High Place East as an affordable ownership model.”

However, as City Hall has already invested $13 million into the project and redevelopment funds are no longer available, the loan was not recommended as a viable option.

Mayor Pro Tem Gleam Davis, Council member Bob Holbrook, and Pam O’Connor were not present at the Feb. 14 meeting.