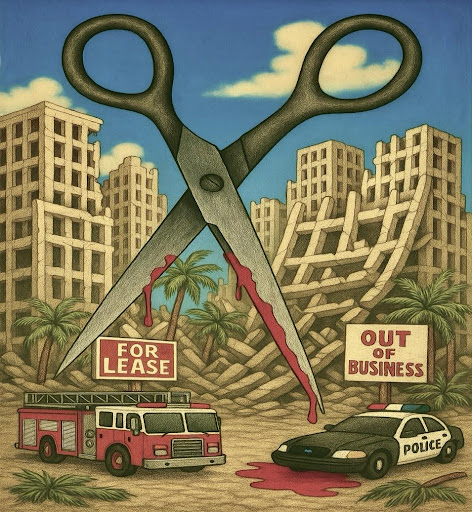

No academic or pseudo-academic study has had more impact on California public affairs this fall than a 32-page tome about what’s wrong with this state, coming from the New York-based Manhattan Institute and bearing the ominous title “The Great California Exodus: A Closer Look.”

Trouble is, this study doesn’t look quite closely enough to get at the real roots of the trend of the last 20 years, in which more Californians have departed to other states than have arrived here from elsewhere in America. Of course, California has not actually lost population from this reversal of the pattern of the previous century: The U.S. Census showed state population was up 3 million in the 10 years between 2000 and 2010, with most of the increase from a combination of foreign immigration and live births. This, despite an outflow to other states of about 3.4 million persons.

Few reported this, but even though California didn’t gain a seat in Congress this decade, its growth was still the largest in the nation. Growth seemed small only because the starting population was so high.

And yet, there remains the reality that when it comes to strictly domestic migration, California lost ground over the last 20 years — although you’d never guess it while sitting in stalled traffic on the 405 freeway in Los Angeles or the Bay Bridge between San Francisco and Oakland. California also lost income, according to the Manhattan Institute report, principally authored by Thomas Gray, a Cambria-based freelance writer who was editorial page editor of the Los Angeles Daily News from 1984 to 1995.

Californians who moved to Texas had $4.07 billion in income between 2000 and 2010; those moving to Nevada took $5.67 billion of income with them, and those going to Arizona $4.96 billion, to name the three leading states in terms of money going to former California residents. Gray and co-author Robert Scardamalia used Internal Revenue Service summaries to reach those figures.

They attribute the outflow from California primarily to three factors: jobs, taxes and density. Yes, California’s big urban areas, the study says, are the densest in America, improbably topping even New York.

No doubt individual reasons for leaving California are complex, but even Gray concedes the Manhattan Institute’s list of factors is incomplete, at best. For there is no mention of the profit motive.

Rather, the study cites – and this is predictable considering that despite its neutral name, the institute is a libertarian-leaning outfit whose board of directors is peopled almost exclusively with representatives of big business – jobs and taxes as the two prime reasons for persons to leave California. As the institute knew it would, that conclusion has already increased the push for lessening regulations on business and industry while also discouraging any possible tax increases.

If you’re trying to get regulations reduced or eliminated and you don’t want more taxes, why talk about the profit motive, or what Gray in an interview called the “cash-out factor.” That’s the incentive many Californians have to sell high-priced real estate, especially in densely-populated coastal counties, buy a far larger place in Arizona, Texas, Nevada, Idaho or Oregon (the leading recipients of California emigrants), and pocket hundreds of thousands of dollars in left-over profits.

“If you’re along the coast, the difference between California real estate prices and those other states is very high,” Gray conceded.

Gray also concedes that “If people are retiring,” the profit motive “can be very important.” But he says he didn’t include it in his study because “No one can quantify this.” He also didn’t calculate how much of the income going elsewhere was in the form of Social Security payments and pensions — usually classed as unearned income.

But here’s an anecdote: A couple from Culver City (true story) retired last spring with hefty pensions and immediately moved to Las Vegas. They sold their longtime home for more than $800,000 and bought a larger, newer place for $280,000. These people had complained for years about California traffic, but was that or the more than half-a-million in profits they pocketed the real reason for their departure?

Similar stories have been repeated innumerable times, enough so it’s probably no longer an anecdote, but an indisputably significant factor in departures from California.

What’s more, someone else bought that Culver City house. Like many, that buyer was an Asian immigrant. But in measuring the outflow of income from California, Gray also didn’t attempt to balance matters by figuring the income of new immigrants. “That can confuse the issue a lot,” he said. No, it might actually clarify things.

For the real confusion comes from not accounting for all the factors at work. When a study leaves out the profit motive, which even that study’s prime author concedes is important, and also ignores money brought to the state by immigrants, that study cannot possibly be considered complete, nor its conclusions valid.

Which means that politicians or pundits who cite the Manhattan Institute study to push for less regulations on business or to discourage any new taxes are basing their suggestions on something very incomplete and highly questionable.