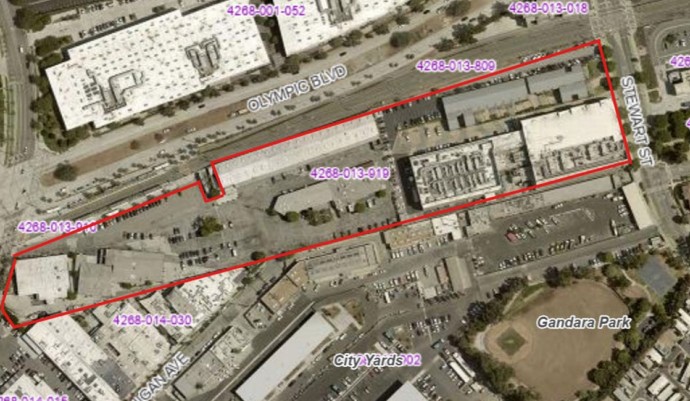

Santa Monica is not Hollywood, but the city certainly has connections to the home base of the American film industry. Not only are there sound stages and production companies within Santa Monica, many film and television employees, executives, or professionals also live here.

Accordingly, Councilman Kevin McKeown sought on June 24 to have his colleagues support Assembly Bill 1839, which aims to “establish competitive state tax credit incentives to retain film and television jobs in California.”

Assemblyman Mike Gatto (D-Los Angeles) introduced the bill in Sacramento earlier this year. Assemblyman Richard Bloom, who previously served on the Santa Monica City Council, was one of the bill’s co-authors.

“TV and film jobs have been increasingly going to other states and other countries,” McKeown said, adding Santa Monica is home to many people who make a living in the creative arts industries, including television and film production.

Mayor Pam O’Connor pointed out that council voted in favor of supporting AB 1839 came on the heels of the news that, for the first time ever, more television pilots are filmed in New York than in Los Angeles.

Though Gatto’s bill has not yet placed a dollar figure of how large the tax credit would be, O’Connor suggested a friendly amendment to the motion that the council support of AB 1839 ultimately has California’s tax credits at least be equal to what New York offers.

According to O’Connor, California currently offers $100 million is tax credits versus $430 million in New York. O’Connor’s amendment seeks to have AB 1839 offer film and television productions within California the same $430 million offered to producers or studio heads to bring filming to New York.

The California Film Tax Credit Program was adopted in 2009 and aimed to create $500 million in credits within a five-year window. AB 1839 seeks to extend those tax credits through 2022.

As part of the extension, the amount of film tax credits available to film and television productions would be expanded. Just the same, the number of productions eligible for tax credits and incentives would also be expanded.

Other amendments proposed in AB 1839 would allow for more types of productions to take advantage of tax incentives if they remain in California.

The City Council unanimously voted in favor of supporting AB 1839. In April, the Los Angeles City Council also voted unanimously to support AB 1839.

The bill is currently in the State Senate; the State Assembly unanimously approved it on May 28.