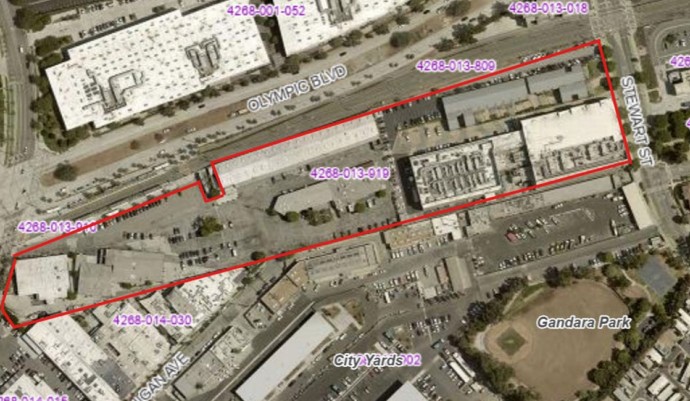

The creation of an affordable housing linkage fee on new development projects moved one step closer to fruition following the Santa Monica City Council’s recent vote on the issue.

Under the guidance of city staff, a nexus study was undertaken by consultants to assess how new commercial development increases the need for affordable housing and to determine the maximum fees that could be charged to mitigate those impacts.

The nexus study was designed to analyze the relationship between commercial development, job creation, and the demand for affordable housing.

Originally combined with a parks and recreation study and associated development-offset fees, council decided to vote on each issue separately.

Staff recommendations suggested an affordable housing commercial linkage fee of 4.5 percent, ranging from $3.07 to $11.21 per square foot, depending on the type of commercial use. Hotel development fell at the lower end of the scale of $3.07, while office and institutional land-use came up on top at $11.21 and $10.23 respectively.

Applauding the city staff study, Councilman Kevin McKeown disagreed with the fee structure at the City Council meeting on Sept. 23, suggesting a higher-yield approach on fewer projects.

Debate oscillated between council members: some concerned that high fees could see an end to development altogether, while others argued less development with higher fees could be the best solution.

Originally moving the motion to pass the first reading of the ordinance with city staff recommendations and rounding up the linkage fee to five percent, after some discussion.

Councilman Tony Vazquez then withdrew his support for the motion and moved a new motion to change the fee structure to 10 percent of the project with the ability to revisit the ordinance in the future. Seconded by Councilman McKeown, the motion failed 5-2.

Reinstating his original motion, to accept city staff recommendations and rounding up the linkage fee to five percent, Councilman Vazquez was then seconded by Councilwoman Gleam Davis and the motion passed 6-1.

“I would like the record to show that my ‘no’ vote reflects the belief that that this was the time to have achieved some real revenue for affordable housing,” said Councilman McKeown, who voted against the motion. “Waiting to negotiate on development agreements has historically shown to not be productive and I think that we have given too much away.”

“This vote tonight show we my continue to give too much away.”

The proposed impact fees are not projected to generate the level of revenues to become primary funding sources for affordable housing, according to city staff, but would supplement other funding sources.

Any development subject to these new fees would not be subject to the existing Parks and Recreation Facilities Tax or the Housing and Parks in-lieu fee currently in the Municipal Code.

The proposed ordinance would provide a credit for existing commercial land uses that are retained or rebuilt as commercial.

Places of worship, city projects, day care centers, private K-12 schools, square footage used for outdoor dining in the public right-of-way, and any commercial component of multi-family rental housing developed by nonprofit housing providers that meet certain criteria, would be exempt from the fees.