Just about two years ago, when gasoline prices in most of California last moved well above the $4-per-gallon level, crude oil cost $147 a barrel. Oil companies said the high price of crude was a major factor in that price spike.

This spring, when gas pump prices again jumped replica watches above $4 in many places, crude oil fell under $50 per barrel for awhile before recovering a bit to around $60 near the end of May.

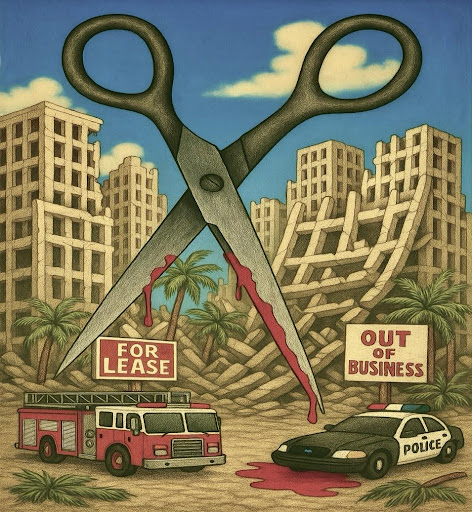

So it’s no wonder consumer advocates rail at gasoline prices, which are back near peak levels after a late-winter respite. In fact, evidence is mounting that prices in this state are being set to gouge consumers, even though there is no certainty of collusion between the four companies controlling almost 80 percent of the state’s gasoline production.

Also pointing toward gouging is the fact that oil companies repeatedly claim gas refinery outages are big factors in California price spikes. When fire hit a non-operational fluid catalytic cracking unit at Exxon’s refinery in the Los Angeles suburb of Torrance, prices rose all over California, yet the burned part of the plant was doing nothing.

Another statewide rise came when there was a labor problem at Tesoro’s refinery in Martinez, east of San Francisco, which has long been unreliable. But there’s no rationale for a refinery problems in Southern California to affect prices in Northern California, or vice versa.

Says a retired 32-year engineer at Valero’s refinery in Benicia, “The pipelines that leave Bay Area refineries do not connect with the pipelines in Southern California.” In short, the fact there may be a shortage for awhile in one part of the state doesn’t mean there will be one in the other large region. A comprehensive Kinder-Morgan Energy Partners map of the state’s gasoline pipelines confirms a lack of linkage between north and south. So while a refinery outage in one half of California might create a bit of a shortage there, it should not affect the other half.

But shortages in one area invariably raise prices around the whole state.

Those two peculiarities definitely suggest gouging. There are also the springtime statements of major oil company executives to their stockholders and financial analysts.

Said Greg Maxwell, chief financial officer of Phillips 66, “First quarter gasoline cracks (the difference between the price paid for crude oil and the price of petroleum products made from it, including gasoline) for the Western Pacific region were $20.21 per barrel compared with $7.46 last quarter, resulting in record earnings for the region.”

Reported a top Chevron official, “Margins increased earnings by $435 million driven by unplanned industry downtime and tight product supply on the West Coast.”

And Tesoro chief executive Gregory Goff said, “In California, crack spreads have improved… There’s no question that during the first quarter with what happened to Tesoro (which sells under the Shell and USA labels, among others) as a result of the (labor) disruption at the Martinez refinery…it was very supportive to the margin environment there.”

In short, when the companies produced less gasoline and charged more for it, their profits soared. So they had no incentive to delay planned maintenance outages at some refineries when unplanned disruptions shut down others. One result of all this was that Californians in late May were paying an average of $1.30 more per gallon for gasoline than drivers in other states. Only about 15 cents of that could be ascribed to the state’s higher gas taxes.

Spokesmen for the Western Oil and Gas Association did not return calls seeking comment.

All this led the Consumer Watchdog advocacy group to call for a federal Justice Department investigation of possible price gouging.

Said the group’s president, Jamie Court, “Since the beginning of February, California’s 14 oil refineries have suffered 10 serious slowdowns or shutdowns. This is the only industry in America that profits more when its factories repeatedly break down. Since four oil refiners control 78 percent of the gasoline market, such an oligopoly can easily withhold needed products to drive up prices.”

Put it all together and it’s clear gasoline prices here are far higher than they ought to be. Whether or not that’s a criminal matter has yet to be determined.