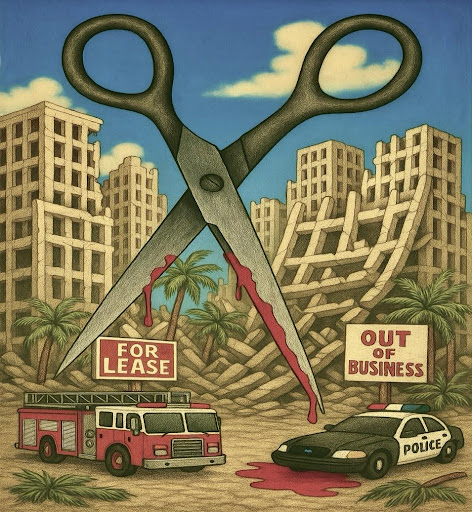

The days when oil companies could credibly deny they’re gouging California drivers just because they’ve dropped pump prices a bit appear now to be over.

For every measuring stick except a comparison with the price of gasoline four months ago leads to the unmistakable conclusion that this state’s three biggest gasoline refiners – Valero, Tesoro and Chevron – are still gouging customers like they did at mid-summer, when prices topped $4 per gallon in many places.

Now prices are down to $2.60 in some spots, while it’s hard to find gas anywhere at prices over $3.60 per gallon.

That’s taking some heat off the big refiners, but it should not. For even when this state’s higher-than-normal gasoline taxes are figured in, Californians are still paying about 60 cents per gallon more than the average price in many other states with far worse access to refined gasoline.

The first thing to understand is that the price is down because the cost of oil has been below $50 per barrel for many months, largely the result of hydraulic fracturing (fracking), which has hugely increased American supplies.

Motorists in most parts of America benefit far more from this than Californians, with prevailing prices in most regions well below $2 per gallon all fall.

To ascertain whether a company is profiteering to take advantage of unusual market conditions, the best place to look is at its profits, which all firms whose stock is publicly traded must make public.

The most prominent third-quarter corporate report among California-related oil companies this fall came from Chevron Corp. The San Ramon-based firm has announced it will cut 11 percent of its workforce, or about 7,000 jobs, as it deals with lower oil prices that cut its company-wide profit about 60 percent below the same quarter a year ago, from $5.6 billion to $2.04 billion.

But look a bit closer and you see how bad things would have been for Chevron but for the money it gouged from California consumers. For the first nine months of this year, the huge corporation’s refining operations netted a whopping $2.6 billion, compared with $1.4 billion last year. Since 54 percent of Chevron’s refining occurs in California, in El Segundo and Richmond, it’s clear that overcharging Californians has been one of Chevron’s most profitable tactics this year.

Then there are Valero and Tesoro, the latter selling much of its gas under the Shell and USA labels. These are the only two big oil companies that break out California-specific refining profits. And what profits they reaped! For Tesoro, the profit was $770 million just from California gasoline refining in the third quarter. This was double the company’s take for the July-to-September period last year and about four times the firm’s average quarterly profit of $169 million over the last 10 years.

Valero, meanwhile, made $342 million on California refining during the third quarter, an almost obscene 14 times more than last year. Its per-barrel profit was $13.54, fully 11 times more than last year’s figure for the same time period in 2014.

All the companies claim their profits were in part due to a partial outage of the Exxon-Mobil refinery in Torrance, but exported gasoline continued to flow from California to Mexico and other destinations throughout the third quarter. If there was a shortage here, why would exports continue?

“Those outsize profits show just how broken the state’s gasoline market is,” said Cody Rosenfield, a researcher for the Consumer Watchdog advocacy group. “Instead of passing on a dramatic drop in the price of crude oil, California refiners imposed extreme and unreasonable pain at the pump for consumers.”

Sure, that pain is a tad less when prices come down. But imagine how many dollars could have flowed into the state’s economy, rather than to the Texas headquarters of Valero and Tesoro, if profits had remained at their previous, already copious levels.

Yes, billionaire activist Tom Steyer threatened last summer to fund and run a ballot initiative requiring disclosure of all refiners’ California profits, among other things, unless the Legislature imposed new transparency rules on the gasoline market by the end of September.

That deadline came and went with no action from either legislators or Steyer, leaving consumers to wonder when anyone will take a hand to stop the ongoing gouging of millions of Californians.