Ballot initiative campaigns don’t usually center around definitions, but the question of what’s a pension and what’s not is one battle over definitions that’s very likely to face voters this fall.

After years of frustration caused mainly because of failed efforts to change and reduce the pensions that are or will be paid to past and present public employees, an ex-mayor of San Jose and an ex-San Diego city councilman now seem all but certain to get their issue to the ballot.

San Jose Democrat Chuck Reed and San Diego Republican Carl DeMaio felt stymied last year when state Atty. Gen. Kamala Harris gave a previous proposal of theirs a tentative ballot description making it seem unconstitutional because it might have taken existing, vested benefits from public employees, including police and firefighters. That polled as so unpopular that the two former public officials pulled back their measure and opted to try again for next November’s ballot.

Something similar happened to ex-Gov. Arnold Schwarzenegger in 2005, when he put forward a public employee pension-cutting measure that would have eliminated death benefits for survivors of police and firefighters killed in the line of duty.

This time, Reed and DeMaio are leaving both current employees and death benefits alone. Instead, they now propose putting new public employees of all types into a 401(k)-style retirement savings plan guaranteeing fixed contributions from the state, cities and counties instead of fixed, promised retirement payments based on their pay at or just before the time they retire. Existing public employees would be unaffected.

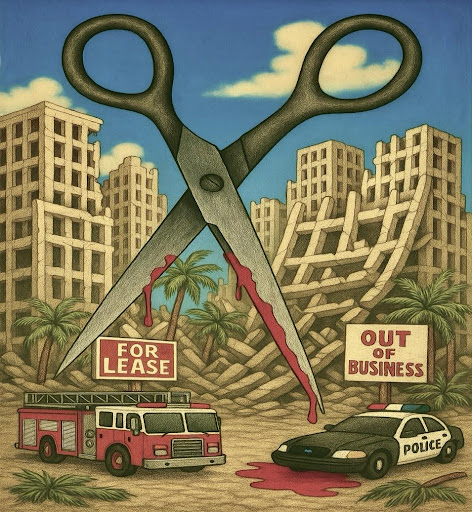

If their plan wins, it would constitute an ironic sort of negative gift for anyone planning to go to work as a cop, a water or highway engineer, a county social worker or food inspector, or a host of other vital public functions.

But it still wouldn’t solve the state’s biggest fiscal problem, the difference between what pension systems are committed to pay to current and impending future retirees, and the money coming into the retirement systems from their investments and employee contributions. That money will have to be made up from state and local budgets, unless stock market conditions improve markedly, and soon.

This reality, and the high pensions drawn by some retired public employees, creates resentment among many Californians. Data released during the fall showed, for instance, that the average former worker who spent 30 full years with the city of Mountain View now draws a pension of about $111,000. Ex-Daly City workers collect just over $97,000 each. And so on, with many payments exceeding the mean California income of about $53,000.

But these are people who spent a generation or more in public sector jobs that often paid less than similar work in private industry. One reason they took those jobs was for the eventual big pensions they figured to draw.

Retired public employees who spent less than 30 years on their jobs bring in far less – an average of $26,150 per year for non-safety employees, or less than half what full-career colleagues collect.

One quarrel if a Reed/DeMaio measure qualifies for next fall’s ballot will be whether 401(k)-style savings accounts really are pensions, or merely retirement benefits. For sure, while defined-benefit pension payments are guaranteed, 40l(k) values and the amounts retirees must take out of those accounts after age 69 depend on stock market performance, an iffy thing at best over the last 10 years.

But Reed and DeMaio stop short of consigning future public employees strictly to that kind of account. Local voters could still go for more traditional pension plans, if workers could convince them that such plans are merited or that it’s impossible to draw enough qualified public workers for vital jobs without them.

“We are trying to control the cost of benefits,” Reed told a reporter. Without a measure like the one he and DeMaio propose, he said, “The problem is only going to get worse.”

For sure, several polls in recent years have shown Californians believe public employees deserve decent pensions. That’s why the question of whether a 40l(k) is really a pension could become decisive next fall.