Much of recent debate in Santa Monica has centered around the idea that changing zoning in single-family zones would result in lower-priced housing units. Recent projects, however, suggest the actual situation may be more complex than it seems.

Our friend and reader Zina Josephs has sent us an example of a recent project and writes:

“Does increased density lead to increased affordability? Apparently not.

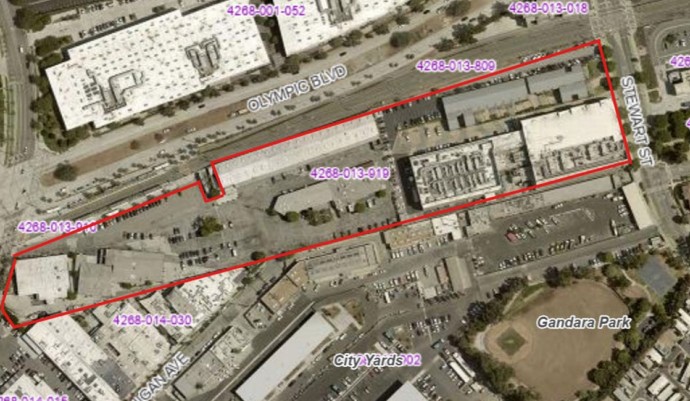

Example: 1927 19th Street, Santa Monica, CA 90404

Sales history:

May 31, 2006 – house sold for $899,000

November 7, 2014 – house sold for $1,195,000

2020 – House is demolished and replaced with three 3-story townhouses

-April 23, 2021 – Unit #A townhouse (2,951 sq ft) sold for $2,090,000

-May 11, 2021 – Unit #B townhouse (2,770 sq ft) sold for $1,989,000

-April 23, 2021 – Unit #C townhouse (2,960 sq ft) sold for $1,950,000,

[sources: https://tinyurl.com/rvd46k9c, https://tinyurl.com/3c246zph, https://tinyurl.com/54b3x9xn, https://tinyurl.com/4px6b8t9]”

Our colleague Marc Verville adds:

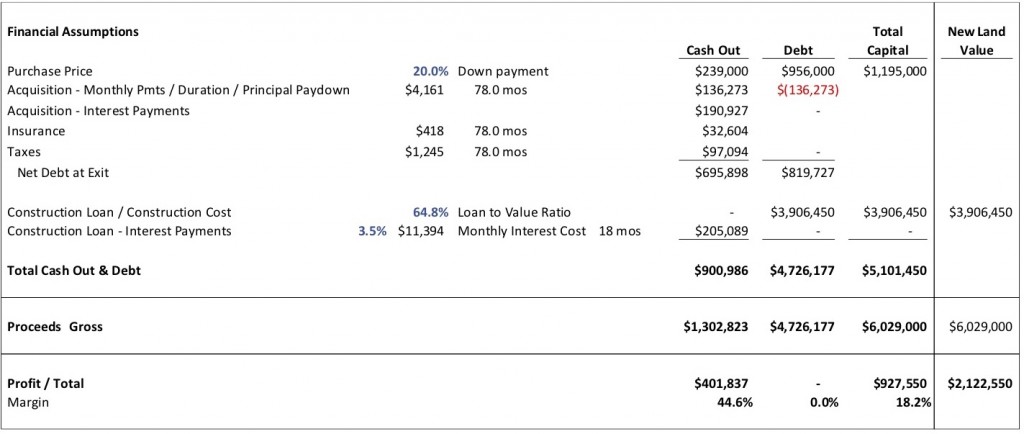

“Making certain assumptions that include a 20% down payment and 100% construction financing, the general outline of the estimated financial return on this project can be outlined as follows:

The property was purchased for $1.195 million on 11-07-2014 with a lot size of 7,995 sf, yielding a total cost of $149 psf. It was redeveloped with the final unit sold on 05-11-2021. Total sales price for the three units was $6.029 million. Total sold area for the three units was 8,681 sf, yielding a sales price of $695 psf.

Assuming a $450 psf construction cost rate, total cash out construction investment (with interest costs) would have been $205,000. Total developer project cash investment would have been $901,000 including down payment and holding costs of interest, taxes and insurance. The developer’s cash profit (excluding any line item profits) would have been $402,000, representing a 45% return on the total cash investment.

The difference between the final sales price and the construction costs is $2.123 million. Compared to the original acquisition cost of $1.195 million, the $928,000 difference would represent a land value increase of 78%. ”

As we see above, once numbers are looked at in detail, new levels of information and understanding become apparent. We’ve included the information in this article as a real-world example of a multi-unit project replacing a single-family residence in the city.

Daniel Jansenson, Architect, Building & Fire-Life Safety Commission

Santa Monica Architects for a Responsible Tomorrow: Ron Goldman, Architect FAIA; Dan Jansenson, Architect, Building & Fire-Life Safety Commissioner; Mario Fonda-Bonardi AIA, Planning Commissioner; Robert H. Taylor, Architect AIA: Thane Roberts, Architect; Sam Tolkin, Architect; Marc Verville accountant ret.; Michael Jolly, AIRCRE