From Sacramento comes word that the median price for a single-family home in California skyrocketed by 24 percent over less than one year, topping $810,000 in May, a rise of almost 30 percent from the previous year.

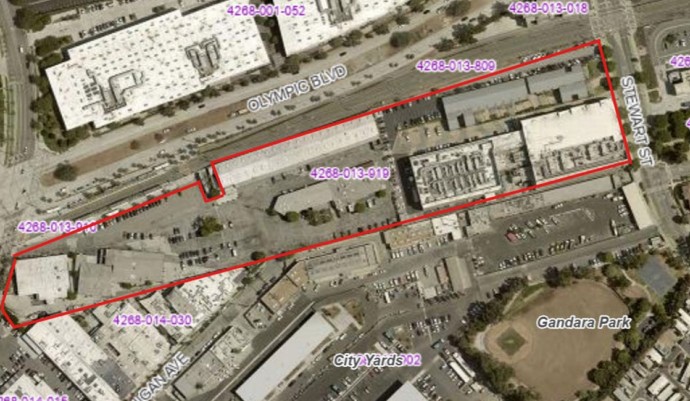

At the same time, one developer of “affordable” housing in Southern California revealed that the average cost of a two-bedroom unit in a new four-story, 48-unit building that will target low-income families, comes to $729,265. Much of that tab will be picked up by local taxpayers, and the building is pretty typical of so-called affordable housing all around California.

Such buildings, the developer said, will likely “increase affordable housing opportunities for families who often have difficulty finding appropriately sized housing” in the region.

Even if thousands of buildings like this one were constructed around the state over the next six years, they wouldn’t come close to solving California’s housing shortage, which some experts say is the main reason median prices keep rising steeply. Gov. Gavin Newsom plumped during his 2018 campaign for building 3 million new units by 2025, a total that won’t even be approached.

Rather than focusing on ways to really resolve the state’s housing problem – and thereby deal simultaneously with the homeless crisis which now sees more than 160,000 individuals sleeping outdoors or in mass shelters every night, winter or summer – state and local officials persist in trying to build ever more expensive new structures.

That’s happening, unreasonably, while the potential solution involving very little new construction stares these same local and state “experts” in the face.

The answer is simple, and will resolve problems for many disparate interests. It’s also inevitable, even if many state legislators and developer interests refuse to see it.

That solution has been obvious since the beginning of the coronavirus pandemic, when thousands of businesses sent their white collar workers home to do their jobs at the same time the businesses themselves started campaigning to get out of long-term leases.

Because many of those companies are delighted to let employees stay home post-pandemic, thus cutting their real estate costs, billions of square feet of former office space are now vacant, most of it likely to stay that way for the foreseeable future.

Law firms, stock brokerages, insurance companies, internet firms – essentially office-based businesses of all types – are dumping their leases, moving to smaller quarters and enjoying the fact their employees appear to be just as efficient away from the office.

Polls indicate about two-thirds of onetime office workers prefer to stay home, where they can set their schedules more independently and save money on both child care and commuting costs.

That leaves building owners holding the bag. Many are real estate investment trusts whose shares are sold as investments to folks expecting regular dividend payments. The main way for them to recover their investments in office towers and other buildings will be to turn them at last partly into residences, as this column first suggested in April 2020, when the trend became obvious to anyone looking.

The current office vacancies do not exist just in California. The New York Times the other day headlined a long-ish story on the office-conversion scene there “Eerie Emptiness in New York.” Quite a contrast to the many previous tales of overcrowded Manhattan.

Once buildings are converted either wholly or in part to residential units, much of the housing shortage will disappear. It’s a far cheaper and easier task than building billions of new square feet, often in places where existing residents don’t want them.

That means fewer lawsuits, less disruption of established neighborhoods, more convenience for most residents. It also means fewer construction jobs, although there will still be plenty of work involved in drywall, carpentry, electricity and plumbing shifts, plus construction of new elevators. But the buildings’ profiles and footprints will not change, giving neighbors little to gripe about.

The real question here is why legislators and local city council and county board members keep pushing more and more new construction, which is obsolete and hard to sell even before it’s built. The answer most likely lies in campaign donations from developers and building trade unions.

So once again, it’s money interfering with inevitable progress and problem solving.

Email Thomas Elias at tdelias@aol.com. His book, “The Burzynski Breakthrough, The Most Promising Cancer Treatment and the Government’s Campaign to Squelch It” is now available in a soft cover fourth edition. For more Elias columns, visit www.californiafocus.net