The Santa Monica-Malibu Unified School District (SMMUSD) joined a “statewide movement” to change California’s property tax system, as board members adopted a resolution Nov. 7 to reform Proposition 13.

Introduced to the SMMUSD Board of Education by member Ben Allen, the resolution seeks equity in the state’s property tax system.

Under Proposition 13, property tax is assessed based upon when it was acquired as opposed to its current market value. Accordingly, government agencies such as school boards contend the current system for collecting property tax is not yielding even revenues, therefore negatively impacting California’s public schools.

“We were adding our voices to a statewide movement that is calling for greater fairness in the state property tax system, making sure that corporations pay their fair share by closing the numerous property tax assessment loopholes that currently exist, and rethinking the way we reassess taxable value for properties that corporations have owned for a long time,” Allen told The Mirror in an email.

Allen cited Disney as an example of how the Proposition 13 tax assessment loophole works.

“Because Disney has owned Disneyland for a long time, they are paying taxes based on Disneyland’s property value in the 1970s – five cents per square foot in property tax while a new homeowner in Santa Monica is likely paying five to 10 dollars per square foot or more in property tax,” Allen said.

A grassroots organization – Close The Loophole – was created to campaign for Proposition 13 reform. The group is circulating a petition on its website, www.CloseTheLoophole.com.

As part of its campaign, Close The Loophole cites statements from San Francisco assessor recorder Phil Ting, who linked California’s low ranking nationwide in public education with the existence of Proposition 13.

“A key part of why California continues to fall behind is Proposition 13,” Ling stated in a released statement. “Prop. 13 proponents initially touted the protections it offered California homeowners, but today the biggest beneficiaries of Prop. 13 are large companies and corporate landowners. Prop. 13 opened up loopholes for corporate landowners and shifted the tax burden to individual homeowners while dramatically reducing California’s tax base.”

Allen echoed Ling’s statement in his email to The Mirror.

“Unlike real people, corporations are allowed under current law to avoid property value reassessments when they purchase new properties by creating carefully tailored shell companies to purchase the property for them,” Allen said. “The current system is unfair to young people, new small businesses, and new homeowners.”

A California-based nonpartisan fiscal and policy advisor, the Legislative Analyst’s Office (LAO), corroborated Allen’s contention.

“Although California’s property tax system provides governments with a stable and growing revenue source, its laws regarding property assessment can result in different treatment of similar taxpayers,” a post on the LAO website stated. “For example, newer property owners often pay a higher effective tax rate than people who have owned their homes or businesses for a long time. In addition, the property tax system may distort business and homeowner decisions regarding relocation or expansion.”

On the other side, the Howard Jarvis Taxpayers Association argues Proposition 13 is indeed fair to recent property owners.

“[Proposition 13] treats equally those who purchase property of similar value at the same time. It provides absolute certainty to homeowners and businesses as to what their tax bills will be in all future years,” a blog post on the Howard Jarvis Taxpayers Association stated. “It prevents property owners’ tax liability from being determined by the vagaries of the real estate market – something over which they have no control. Instead, the amount of property tax liability will depend almost exclusively on the voluntary act of purchase.”

At the heart of the resolution is whether the SMMUSD Board should support Proposition 13 reform to close a loophole allowing corporations to avoid a reassessment of property.

The overall spirit of the resolution was briefly explained in the notes published by the SMMUSD after the Oct. 17 meeting.

“Proposition 13, passed in 1978, created limits on the property taxes paid by residential and commercial properties. California public schools receive funding from these property taxes,” the published notes stated. “The resolution argues that the method by which the value of commercial properties in California are reassessed be modified to allow for more regular commercial property value reassessment, thereby benefitting public schools in California.”

According to the Close the Loophole website, California loses an estimated $7.5 billion annually due to Proposition 13’s tax loopholes.

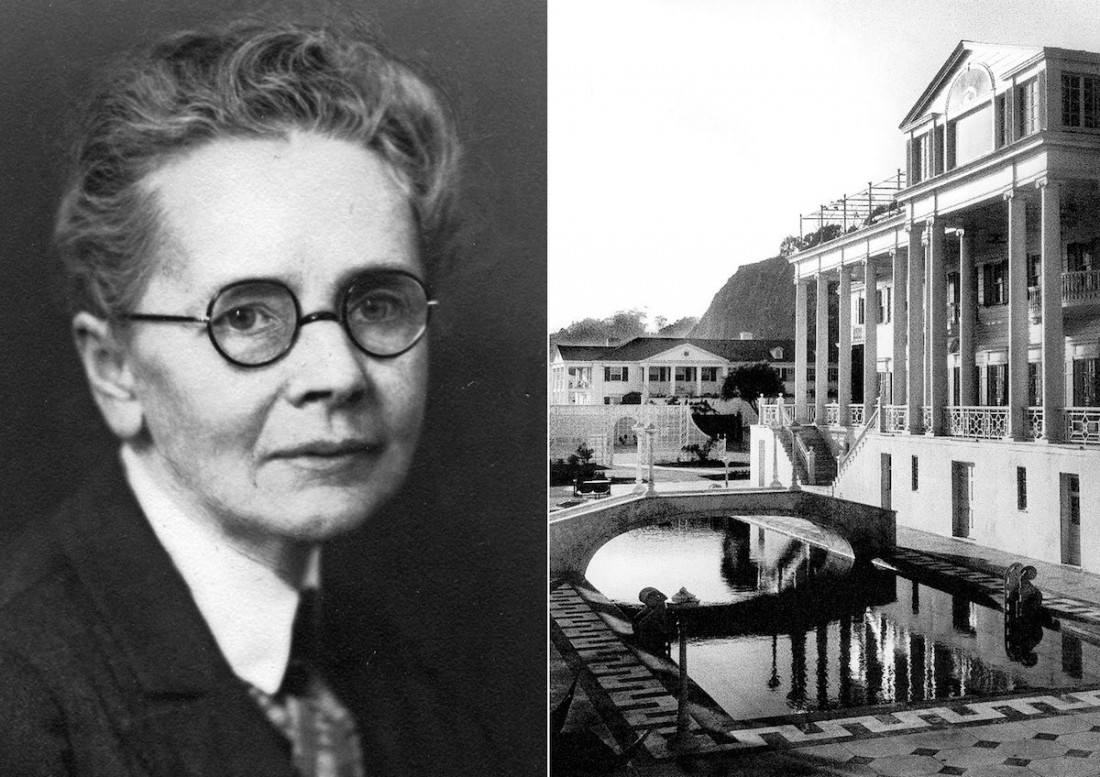

Proposition 13 became an issue in Santa Monica after the Los Angeles Times reported how computer tycoon Michael Dell, thanks to the law’s acquisition value loophole, saved on his tax bill when he acquired the Fairmont Miramar Hotel.

The Los Angeles Times article also noted since Proposition 13’s passage in 1978, the burden of paying taxes to the state shifted from corporations to homeowners, with the tax contribution of Los Angeles County homeowners at 57 percent versus 40 percent in 1975.